Tropics of Finance

If there is any logic presiding over the transition from the level of fact or event in the discourse to that of narrative, it is the logic of figuration itself, which is to say, tropology. This transition is effected by a displacement of the facts onto the ground of literary fictions or, what amounts to the same thing, the projection onto the facts of the plot-structure of one or another of the genres of literary figuration.1

It should be our readings that determine what precisely constitutes the transaction; the transaction themselves cannot come to us performed. Only when we, as critic, re-present the object can we determine whether and how it can or cannot be represented.2

In a discussion of Marx’s famous declaration about history repeating itself (first tragedy, then farce), Hayden White strikes on an incredibly useful formulation for understanding the relation between literary texts and financialization. Written at the height of the 1980s, White’s essay “The Question of Narrative in Contemporary Historical Theory” offers this tantalizing claim: tropology is the logic that presides over the transition from the level of fact (White’s chronicle of events) to the level of narrative (allegoresis).3 White characterizes the movement from what takes place, through discourse, to story as allegorical and offers a way to think with Leigh Claire La Berge’s excellent book Scandals and Abstraction, which I have been tasked with reviewing here. In what follows I would like to claim that Scandals and Abstraction is as much a book about mediation as it is one about political economy and financialization. This observation may be of no surprise to those of you familiar with La Berge’s work. The central concern of her book is to demarcate what she names “financial form” and to demonstrate how it operates in the U.S. in the 1980s. Finance, in La Berge’s account, is intensely representational, which is why literary form itself offers such a useful way into the boggy mire of financial terminology, operations, and logics. As I hope to show, Scandals and Abstraction already thinks alongside White, and other narratologists, and, once it straightens out methodological approaches to studying finance, it has a thing or two to teach us about literary theory.

Part literary analysis and part historiography, La Berge’s book does a wonderful job framing objects. The book features everything from the novels and films we might expect from studies of finance and literature in the ‘80s to high-wheeler autobiographies and cultural theory. You can expect to read about novels by Don DeLillo, Brett Easton Ellis, Jane Smiley, and Tom Wolfe; films by Brain De Palma and Oliver Stone; and, autobiographies by Ivan Boesky, T. Boone Pickens, and Donald Trump. In La Berge’s words: “During the period that I examine, finance manifested in multigeneric (novel, autobiography, reportage), multimedia (print, film, computer screen), and multimodal (realism, postmodernism) forms” (7). La Berge adds that financial print culture gets inflected through “ekphrastic and multi-media presentations,” enumerating

the novel about the business newspaper; the newspaper article about the financial novel; the movie about the stock chart; the automated teller screen that narrates a story; the credit card statement that refers to an image; the novel that narrates the bank fraud which had already been chronicled in a true-crime exposé. (11)

What you might not expect is to be reading about Walter Benjamin’s theory of genre or Paul Ricoeur’s articulation of temporality. La Berge skillfully brings the pulp, the literary, and the philosophical together with the gritty, the base, the financial, and the violent workings of late capitalism. In La Berge’s words, Scandals and Abstraction “is about what happens to narrative form when too much money circulates at once” (3). The central claim in the book is that finance operates through representation, yet this figural life does not mean that it is separate from an “actual economy” (i.e. it is a material process), nor does it mean that it is separate from logics of domination, especially white masculinity.

While financial form seems to share a modus operandi that hinges on re-presentation and the inclusion of samples from other forms, it also generates ways of understanding and depicting finance that are in tension. Following these rifts, La Berge seems to understand genre — as I have come to only very recently — as a field of contest. She defines finance through 1980s generic representations, especially as it appears in the postmodern novel, realist novel, realist film, and, what she calls, financial print culture. These generic forms vie over the terrain of how financialization — which La Berge understands as a recurring historical moment within the capitalist mode of production vis-à-vis the work of Frenand Braudel and Giovanni Arrighi — gets represented, and also what it means to be financial subjects.

From the very beginning, we find that the turbulence of financialization creates interpretive problems — from the outside inquiries are baffled (“what exactly is happening within financial processes?”), while from within financial culture itself the line of questioning becomes “what will happen?” Put differently, outsiders struggle to pick up on the story, which gets emplotted all too quickly and never in a single form, while insiders take on faith that something like resolution will confirm their anticipated outcome. Indeed, La Berge points out that the term finance comes from the “Latin noun finis (the end) and French verb finir (to end)” and that it can be described as “an orientation and a contestation over futurity” (17, 12). For La Berge, the problems of interpretation that swirl around finance and its orientation towards the future make it especially prone to be understood vis-à-vis narrative.

Scandals and Abstraction locates a rift in narrative form within the archive of novels, films, and financial print culture between postmodernism, on the one hand, and realism on the other. In the moment of the 1980s,

the postmodern sensibility called for the radical newness of finance to effect an aesthetic rupture with the present while the realist sensibility called for the repetition of finance to resuscitate the dominant aesthetic mode that had been used to capture and critique finance from the gilded age to the roaring twenties to the Great Depression. (8)

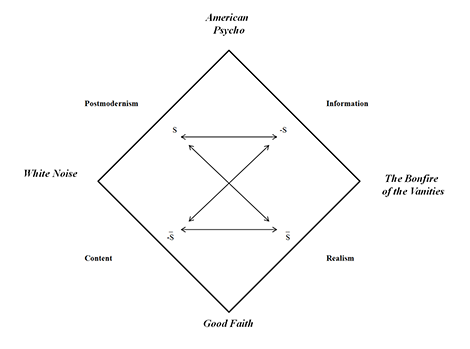

Or, in another formulation that leaps out from the page, La Berge writes, “finance is capitalism’s repetition compulsion in times of crisis” (10). But, she turns away from the compulsion to repeat arguments either for postmodern or realist understandings of finance, and instead develops an incredible sublation of financial form that lives up to both components of her title: indeed, the book generates both a scandal and an abstraction (in the best senses of both words!). Late in the book La Berge makes passing reference to the French structuralist A.J. Greimas, a formative thinker for narratology especially in the work of Fredric Jameson. La Berge comments that “a Greimasian square could easily represent the transmutation between legitimate and illegitimate financial value and between legitimate and illegitimate forms of sexuality and congeniality” in Jane Smiley’s novel Good Faith (181). Here’s the scandal: I want to take this opportunity to read Scandals and Abstraction as one long elaboration of La Berge’s own Greimasian square — one where financial form gets constituted by the dialectical synthesis and negation of realism and postmodernism as literary modes. And here’s the abstraction: each chapter of the book can be conceived as an elaboration of one quadrant of the Greimasian dialectic.

Chapter One, “Personal Banking and Depersonalization in Don DeLillo’s White Noise” delves into DeLillo’s 1985 novel and its domestic space of personal banking. The novel is also one of if not the first to feature an automated teller machine (and, as La Berge is quick to point out the technology is so new that DeLillo does not even use the short form “ATM” here). One central insight La Berge gets from the novel is the distinction between narrating and telling, narrator and (automated) teller. The narrator, Jack Gladney, La Berge reminds us, claims that “all plots move deathward” (47). She also draws the distinction between narrating and telling around the inclusion of the separated fragments of text that appear to bear no direct relation to the narrator. For instance, the passage that simply names credit card companies: “Master Card, Visa, American Express” (in Le Berge 61). At stake in these narratological distinctions is the difference between content (of a novel, of a narrative) and information (of a financial transaction). The dialectic between content and information, it turns out, cannot be managed on its own but gests overdetermined by the conflict between realist verisimilitude and the postmodern denial of lived reality — in some sense both content and information become merely content or merely information.

Chapter Two, “Capitalist Realism,” moves into realist terrain and offers a reading of Tom Wolfe’s novel The Bonfire of the Vanities (1987) and Oliver Stone’s film Wallstreet (1987), both of which espouse to realistically depict finance — something that has been claimed too complex for understanding. Working through these texts’ surprising capacity to represent finance through realism, La Berge supplements Mark Fischer’s terminology by using the term capitalist realism “to indicate the realistic representation of the commodification of realism” (75). La Berge coldly observes both texts turn to melodrama in order to escape the conflict of information and content: Wolfe’s novel tracks the fallout from the accidental killing of Henry Lamb rather than tracing racial disparities back to class, while Stone’s film dramatizes the manipulation of information through a character desperate for paternal approval. In both cases, the narrativization of finance leads to crises of financial masculinity, rather than crises of finance. Meaning neither DeLillo’s postmodern organization of content nor Wolfe’s and Stone’s realist sorting of information manages to accomplish a complete framing of financial form on their own.

In the third chapter, “The Men Who Make the Killings,” we arrive at a synthesis of the two earlier approaches: Bret Easton Ellis’s novel American Psycho (1991) takes the figurative comparison of finance with violence that is so common in financial print culture and inverts it. La Berge argues that the infamous narrator, Patrick Bateman, is actually not a narrator at all, but a teller. Indeed, the ATM enables “Patrick to circulate through the city and to be articulated in a financial network” (134). La Berge directs our attention to a crucial point — violence in the novel tends to happen in the vicinity, spatial or temporal, of the ATM and produces a strange effect: in a narrative, “it is acceptable to have senseless violence. That’s the culture of late modernity, after all… but senseless banking,” the novel asks, why would someone do such a thing (135)? In this way, La Berge brings together realism and postmodernism, content and information into a synthesis where Ellis’s postmodern novel is based in Wolfe’s realist novel’s plot and the narrator himself embraces becoming teller, in a hyper-violent form of financial masculinity that supersedes Jack Gladny’s muted domestic masculinity altogether.

But, La Berge’s Greimasian square doesn’t end with the synthesis of the first two chapters. There remains a neutral term, a leftover that fuses realism and content with domestic plot and melodrama. Chapter Four, “Realism and Unreal Estate,” turns back to the savings and loans scandals of the late '80s, especially as seen in Jane Smiley’s Good Faith (2003). The plot of the novel revolves around the relationship between two men, a real estate agent and a confidence man. The latter absconds with the cash that the two were going to invest in a construction deal leaving the former, the narrator, in a position of retrospection. The novel, La Berge posits, precisely because of its depiction of the interwoven “sexual, financial, and criminological discourse,” captures the bait and switch of the S & L crisis itself (176). In La Berge’s words,

The S & L crisis, as a collection of individual transactions and a noneventful financial event, is crucial to the realization of financial value in the 1980s because it disavows narrative in its present representation only to demand it in retrospect; it manages multiple discourses and idioms… as it moves from fraud to fiction, from complexity to aporia. (172)

This unreal estate, in La Berge’s account, comes to stand in for the space of possibility opened in the present. Finance may be fictitious capital, ever hopeful to find a material berth in the future, and yet it has very real consequences in the present, as evidenced by the S & L scandal and Smiley’s narrativization of it.

In considering the work Scandals and Abstraction does to chart the territory of financial form in the U.S., I am reminded of Jameson’s useful comment in his introduction to the English translation of Greimas’s On Meaning (1987):

To see the square as the very image of closure tends to encourage some pessimism about the possibilities of escaping from it in any other way than the Hegelian one: one does not resolve a contradiction; rather, by praxis, one alters the situation in such a way that the old contradiction, now dead and irrelevant, moves without solution into the past, its place taken by a fresh and unexpected contradiction (which may or may not be some advance on the older aporias or ideological imprisonment).4

La Berge’s thought provoking analysis of '80s financial form has helped to set new terms for the struggle over the future. The elaboration of financial form as a locus of contest over meaning-making contributes much worth to current debates over finance in cultural and literary studies. The book also makes a significant contribution in terms of its display of methodological rigor (take heed fellow junior scholars — this is how to do it right!). La Berge shows what it means to take seriously one’s interlocutors, even as one critiques them mercilessly. Scandals and Abstraction shows what can come from the careful scrutiny of a problem’s complex overdeterminations and in doing so it champions the explanatory power of a Marxism that takes heed of narrative theory, critical race and gender studies, and the study of print culture. If you want to know more about how to elucidate contradiction, or if you just want to know a little more about financialization, this book is for you.

- Hayden White, The Content of the Form: Narrative, Discourse, and Historical Representation (Baltimore: The Johns Hopkins UP, 1987) 47.

- Leigh Claire Le Berge, Scandals and Abstraction: Financial Fictions of the Long 1980s (Oxford: Oxford UP, 2015) 181.

- White, Content 47.

- Frederic Jameson, “Foreword to A. J. Greimas’ On Meaning: Selected Writings in Semiotic Theory,” The Ideologies of Theory (New York: Verso, 2008) 527.